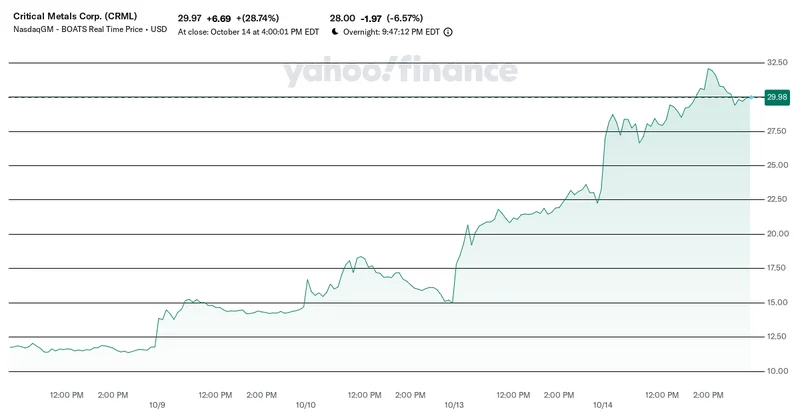

Every so often, you see a signal in the noise. A flicker on the stock market ticker that isn't just about quarterly earnings or a new product launch. It’s a tremor that hints at a much deeper, tectonic shift happening beneath the surface of our world. The recent, explosive surge of a relatively small company called Critical Metals Corp. (CRML) is one of those signals. On the surface, it’s a stock that shot up over 250% in a month, a move that had many asking, Why Is Critical Metals Stock (CRML) Soaring Today? But if you look closer, what you’re really seeing is the frantic, exhilarating birth of a new economic reality.

I’ve spent my career watching technology change the world, from the labs at MIT to the boardrooms of Silicon Valley. And let me tell you, the story of CRML isn't a finance story. It's a story about the future. It’s about who will build the next generation of everything—from electric vehicles and wind turbines to the advanced defense systems that keep us safe. For decades, we outsourced the bedrock of that future. Now, we’re waking up and realizing we need to build it for ourselves.

When I first saw the headlines about a potential Trump administration equity stake, followed by the JPMorgan Chase announcement to pour billions into national security industries, I honestly just sat back in my chair, speechless. This wasn't just market chatter; it was a declaration, a moment when USA Rare Earth, Critical Metals Stocks Explode. It was the financial and political might of the United States pointing like a giant neon sign toward a single, urgent problem: our dangerous dependence on China for the materials that power modern civilization.

The Great Decoupling Begins

Let’s be clear about what we’re talking about. The term "rare earth elements" is a bit of a misnomer. They’re not all that rare, but they are incredibly difficult to mine and refine. In simpler terms, these are the indispensable "vitamins" for technology. Your smartphone, the magnets in an EV motor, the guidance system in a missile—none of them work without these obscure metals. For years, China has strategically dominated this market, controlling the processing and supply with an iron grip.

This is the equivalent of letting a single, rival nation control the world's oil spigots in the 20th century. It’s a staggering strategic vulnerability. So when former President Trump started rattling the cage with 100% tariff threats and Beijing responded by tightening its export controls, it wasn't just a trade spat. It was the moment the chess clock started ticking. What happens when the sole supplier of your most critical components decides to turn off the tap?

This is where a company like Critical Metals enters the picture. Their flagship Tanbreez Project in Greenland is one of the world's largest deposits of these crucial heavy rare earths outside of China. Suddenly, a mining project in a remote corner of the world becomes a linchpin in a global geopolitical strategy. It’s no longer just a hole in the ground; it’s a source of independence. It's a strategic asset of monumental importance. Are we just now realizing how vital this is? How did we let ourselves get into a position where the building blocks of our entire technological future were in the hands of a geopolitical competitor?

The money flowing in confirms this shift isn't temporary. JPMorgan, led by Jamie Dimon, isn't known for chasing speculative fads. Their pledge of up to $10 billion for direct equity stakes in industries vital to national security—with critical minerals listed first—is a watershed moment. Dimon himself said it has become "painfully clear" that the U.S. is too reliant on unreliable sources. This is the financial system acknowledging that the supply chain is no longer just a business school concept; it's a matter of national survival.

Forging a New Industrial Backbone

If the geopolitical tension was the spark and the big bank investment was the fuel, then the recent deal with REalloys Inc. is the engine catching fire. REalloys signed a letter of intent for a 10-year agreement to buy a significant portion of the concentrate from the Tanbreez project. This is what’s known as an "off-take agreement"—basically, it’s a promise to buy what the mine produces for a decade. For a company like Critical Metals, this is everything. It’s a guaranteed customer, a stable revenue stream, and a massive de-risking of the entire endeavor before the first ton of earth is even seriously moved.

This convergence of private capital, government interest, and commercial agreements is just staggering—it means we are witnessing the creation of a secure, North American-centric supply chain for the technologies of the 21st century in real-time. It’s a moment that feels analogous to the race to build the Transcontinental Railroad. That wasn't just about laying track; it was about uniting a continent, securing its economic future, and projecting national strength. This is the 21st-century version of that grand project, only instead of steel rails, we’re laying a foundation of neodymium, dysprosium, and terbium.

Of course, Wall Street seems a bit behind the curve. I saw one analyst report that, despite a "Moderate Buy" rating, slapped a price target on CRML that implied a 40% downside risk. This, to me, is a classic case of using old maps to navigate a new world. Analysts are looking at balance sheets and cash flow projections, as they should. But how do you quantify the value of breaking a strategic chokehold? What’s the price-to-earnings ratio on technological sovereignty? They are valuing a company, but they are missing the valuation of an entire industrial paradigm shift.

This isn’t to say there aren’t immense challenges. We have to pursue this path with our eyes wide open. The responsibility to mine these resources in an environmentally sustainable way, especially in a place as pristine as Greenland, is non-negotiable. Securing our future can’t come at the expense of the planet's health. That’s a test we must pass.

But the momentum is undeniable. We are watching the gears of industry, finance, and geopolitics grind into a new alignment. It’s messy, it’s volatile, and it’s incredibly exciting. We are moving from a world of fragile, hyper-efficient global supply chains to one that prioritizes resilience and security. And companies like Critical Metals are right at the epicenter of that historic transformation.

The Bedrock of Tomorrow is Being Laid

This is so much bigger than one company's stock chart. What we're witnessing is the first chapter in the story of America's industrial renaissance. For decades, we were told that the future was purely digital, a weightless world of code and clouds. We forgot that the cloud runs on servers, the code runs on silicon, and the entire green energy revolution runs on minerals pulled from the earth. We are finally remembering that to build the future, you first need a foundation. Right now, before our very eyes, that foundation is being secured.