Alright, let's talk about this new IRS initiative – the $1,390 relief payment hitting bank accounts in November 2025. Now, I know what some of you are thinking: is this just another drop in the bucket? A band-aid on a wound that needs serious surgery? But I think it’s worth digging a little deeper, because sometimes, the smallest actions can create ripples far beyond what we initially expect.

A Lifeline in a Sea of Rising Costs

The core idea here is simple: get money into the hands of people who are feeling the pinch of inflation the most. We're talking about single filers earning less than $75,000 and married couples earning less than $150,000. And let’s not forget those relying on Social Security, SSDI, and SSI – they’ll automatically receive the $1,390 payment. The goal? To help folks cover necessities, maybe even start chipping away at those debts that have been piling up.

Now, I know what the cynics are saying. They’re calling it a “pittance,” a “political stunt.” But I see something different. I see a targeted approach, a laser focus on those who need it most. This isn’t like the broad stimulus checks of the pandemic; this is about directly addressing the pain points caused by rising prices. It's like fine-tuning an engine instead of flooding it with fuel.

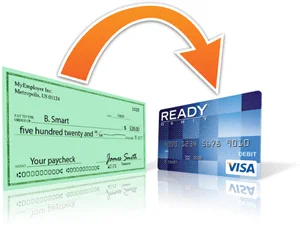

And the speed! That's what really grabs me. Direct deposits starting in November 2025 for those with bank records already on file with the IRS. The IRS is even updating their "Get My Payment" page so people can track the status of their relief. It's all managed through the Social Security and tax systems.

The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend. And the fact that Social Security recipients will automatically receive the payment is a huge win. Think about the peace of mind that provides to some of the most vulnerable people in our society.

But here’s the thing that really gets me thinking: what if this is more than just a one-time payment? What if this is a test run for a more responsive, more agile social safety net? Imagine a future where government assistance can be deployed quickly and efficiently, targeting specific needs in real-time.

Of course, there's a risk. Any system dealing with this much personal financial data needs to be incredibly secure. The initiative is intended to minimize fraud and guarantee a quicker, safer procedure, but how can we ensure that? We need transparency, robust security measures, and constant vigilance to protect people’s information.

This also gives me pause. This initiative is being managed through the Social Security and tax systems. This is a good thing, as it allows for a quicker, safer procedure. But is it too much power for the system? What are the ethical implications of such a concentration of power?

Is This a Revolution in Progress?

Think about the printing press. Before Gutenberg, knowledge was hoarded by the elite. The printing press democratized information, unleashing a wave of innovation and social change. Could this targeted relief payment system be a similar catalyst? Could it pave the way for a more equitable and responsive society?

I know, I know – it sounds like I'm getting carried away. But that's what gets me so excited about this. The possibilities are endless. What this means for us is not just a one time payment, but more importantly, what could it mean for you?