The VIX: Still a Thing? Or Just Another Wall Street Mirage?

Volatility. The VIX. You hear these terms thrown around like everyone knows what they mean. Let's be real, most people—including some professionals—couldn't explain it if you held a gun to their heads. And honestly, who cares anymore?

Decoding the Alphabet Soup

Cboe Global Markets wants us to believe the VIX is "the world’s premier gauge of U.S. equity market volatility." Premier? Says who? Them? It's like a fast food chain calling their burger "award-winning." Give me a break.

They trot out this history lesson about how it started with the S&P 100, then they "updated" it to the S&P 500 with Goldman Sachs in tow. Goldman Sachs. That's all I need to hear. You know, the same Goldman Sachs that helped create the mortgage-backed securities that nearly cratered the entire global economy? Yeah, I'm sure they had our best interests at heart when they tweaked the VIX.

And what does it even mean to "measure the market’s expectation of 30-day volatility"? It sounds like something Nostradamus would say. Is it actually useful, or just a fancy way for hedge funds to fleece retail investors? I mean, if I could actually predict the future, I wouldn't be writing this column, I'd be on my yacht.

Data Dump or Dead End?

Cboe is happy to sell you historical data. Custom VIX options and futures historical data on-demand! Visit DataShop! It's all about the Benjamins, baby. They even have "older data" for the VXO, the original VIX. So, it's like they're admitting the current VIX is just a re-branded version of something that already existed. Genius.

Of course, there's the standard CYA disclaimer: "...furnished without responsibility for accuracy...accuracy is not guaranteed." So, basically, "Here's some data. Good luck. Don't sue us if you lose your shirt." Real reassuring, offcourse.

I went looking for some hard news or analysis about the VIX to balance this out and...nothing. Seriously, the link Newser provided is a dead end. "We're sorry, but the page you have requested does not exist." That about sums it up, doesn't it? Maybe the VIX itself is just a phantom page, a figment of Wall Street's collective imagination.

Wait, I'm being too harsh. Maybe it's ME who's missing something. Maybe there's a secret society of volatility traders who are using the VIX to unlock the secrets of the universe. Then again, maybe I just need another cup of coffee.

The Illusion of Control

Here's the thing: all these indices, all this data, all this "sophisticated" financial engineering...it's all just a way to create the illusion of control in a world that is fundamentally chaotic. The market is going to do what the market is going to do. You can try to predict it, you can try to hedge against it, but in the end, it's all just a crapshoot.

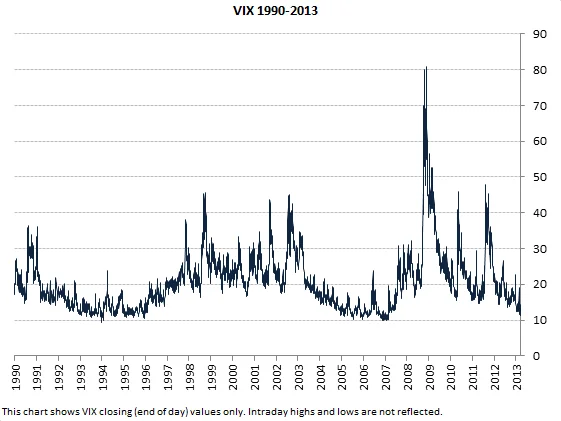

It's like trying to predict the weather by staring at a barometer. Sure, the barometer might give you some clues, but it ain't going to stop a hurricane. And the VIX certainly didn't stop the 2008 crash, did it? Or the dot-com bust? Or any of the other economic calamities that have befallen us?

This Whole Thing Smells Fishy

Let's be honest—the VIX seems less like a reliable gauge of market volatility and more like a self-serving product peddled by the financial industry to justify its existence. And honestly, I'm not buying it.